|

News

|

LCG, March 6, 2026--Entergy yesterday announced approximately $5 billion in total savings for 2.3 million customers in Arkansas, Louisiana and Mississippi resulting from data center customer agreements in those states. Entergy, which completed its first data center customer agreement in 2024, projects the customer savings over the next 20 years and after the regulatory approval or acknowledgement of the public service commissions in those states.

Read more

|

|

LCG, March 5, 2026--The Nuclear Regulatory Commission (NRC) announced yesterday that it has authorized the staff to issue TerraPower’s subsidiary, US SFR Owner, a construction permit for the company’s Kemmerer Power Station Unit 1 commercial nuclear power plant in Kemmerer, Wyoming.

Read more

|

|

|

Press Release

Congestion on the Horizon for the SPP Integrated Marketplace

LCG, December 19, 2013 – LCG Consulting (LCG) of Los Altos, California has performed an electricity market assessment and forecast of SPP. Congestion is imminent.

SPP Integrated Market: Co-optimized Products- Day Ahead Energy

- Real Time Energy

- Virtual Energy

- Day Ahead Regulation Up

- Day Ahead Regulation Down

- Day Ahead Spinning Reserve

- Day Ahead Supplemental Reserve

- Real Time Regulation Up

- Real Time Regulation Down

- Real Time Spinning Reserve

- Real Time Supplemental Reserve

|

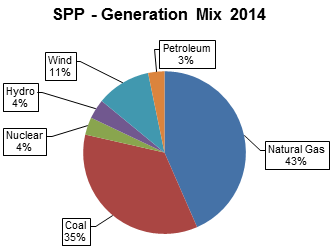

SPP Integrated Marketplace March 2014 marks the start of the completely redefined market structure in the Southwest Power Pool (SPP), termed the “Integrated Marketplace”. This is a significant transition and includes an entirely new approach to coordinating power production, consumption, reliability and settlement. Where previously 16 Balancing Authorities committed their own generation and market prices were relevant only for the amount of power utilized for balancing, the Integrated Marketplace will include a centralized commitment and market prices for the forward (Day Ahead) and Real Time markets. In addition, a number of co-optimized products will be offered.

Market Participants will be able to utilize co-optimized markets along with new market instruments to operate more strategically in the Marketplace such as:

- Bilateral Settlement Schedules

- Transmission Congestion Rights

- Virtual Transactions

To understand the new SPP Market and how it operates, it is helpful to investigate the fundamental elements which drive it. By looking at the fundamentals along with the protocols that will govern market operations, we can gain tremendous insight into what to expect.

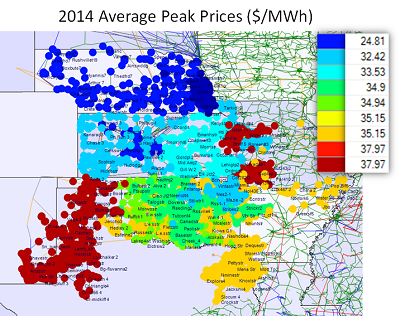

Using UPLAN, an integrated fundamental model which has been designed to simultaneously replicate the physical and financial operations of the power system, LCG has run comprehensive, chronological simulations of SPP to determine how the system will operate. Some observations from these simulations follow.

Locational Marginal Price Forecast - High prices will be found around the Kansas-Oklahoma border and Texas-Panhandle.

- Low prices are forecast for the southwestern border (SUNC, NPPD).

SPP is aggressively adding transmission, including a number of recently completed 345kV projects. The 2013 SPP Transmission Expansion Plan (STEP) includes $6.7Billion in projects and will be included as appropriate with realistic in-service dates within LCG’s simulations.

Even so, price spreads will be seen throughout the footprint. For more information on the SPP Integrated Marketplace, the forecasting tools used to predict the congestion and prices that can be expected or any other queries, please contact:

Julie Chien

Julie.chien@energyonline.com

1(650)962-9670 ext. 110

|

|

|

|

UPLAN-NPM

The Locational Marginal Price Model (LMP) Network Power Model

|

|

|

UPLAN-ACE

Day Ahead and Real Time Market Simulation

|

|

|

UPLAN-G

The Gas Procurement and Competitive Analysis System

|

|

|

PLATO

Database of Plants, Loads, Assets, Transmission...

|

|

|

|

|